Tax Clinic Update

Our tax clinic will be open for two sessions every Monday (except holidays), 9 am – 12:30 pm & 1 pm – 3:30 pm, from March 2, 2026, to April 27, 2026. Then back to one session every Monday from May 4, 2026 to January 31, 2026.

Tax Clinic Location

Bissell tax clinics will now be held at Bissell East – back entrance only (10527 96 St). We are able to support families and caregivers with children with their taxes within the space.

Super Clinic

The Canada Revenue Agency and Service Canada will be on site to support clients once per month, 9 am – 2pm.

Super Clinic Location

Super clinic will be held at Bissell East – back entrance (10527 96 St). Same location as our regular clinic.

Super Clinic Dates for 2026

Mar. 9, 2026

Apr. 20, 2026

May 4, 2026

June 15, 2026

July 13, 2026

Aug. 10, 2026

Sept. 21, 2026

Oct. 5, 2026

Nov. 2, 2026

Dec. 14, 2026

About Bissell Tax Clinics

Filing your taxes every year is important to ensure you are receiving all the government benefits and subsidies you are eligible for. Even if you are not employed or do not have income, you still need to file your taxes. Bissell can help with free tax filing.

Our service is free and confidential.

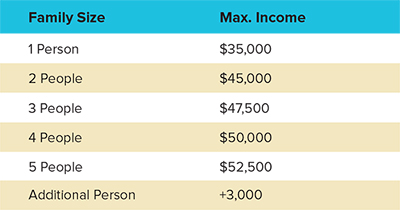

Are you eligible?

What is the process?

- Gather all your documents listed in the “what you need to bring” section below.

- Come to Bissell Centre East at 10527 96 St. NW in Edmonton during Drop-Off Tax Clinic hours. We do not take appointments.

- Staff will assist you to fill out the required forms and check your documentation.

- All your paperwork will be put into an envelope for volunteers to use to complete your tax return throughout the week.

- Tax confirmation papers will be available for pickup at reception during office hours, Monday to Friday, 9 am – 4 pm.

What you need to bring:

- Government ID

- Social Insurance Number (SIN)

Tax Slips:

- T4, T4E, T5, T5007

- T4A, T4A(P), T4A(OAS); Pension

- T2202A; Tuition

Receipts For:

- Charitable donations

- Medical/dental

- Child Care

- RRSP Contributions

- Last Year’s Notice of Assessment

If you are missing any of these items, you can call CRA at 1-800-959-8281. We can still prepare your taxes if you do not have the above information. Just attend the Drop-Off Clinic for assistance.

We do not prepare:

- Self-employed income tax

- Rental income

- Farming & fishing income

- Bankruptcies

- Deceased persons

- Interest exceeding $1000

- Other tax returns that require a professional accountant

Who will be filing my taxes?

Our tax clinic continues to be a volunteer-run tax preparation service. All volunteers are registered through the CRA’s CVITP (Community Volunteer Income Tax Preparer) program, where they undergo a screening process. All volunteers are trained on filing processes and with the support of our staff can assist you with any questions that you may have.

To request T-Slips and other tax help, call CRA: 1-800-959-8281